Association of Municipalities of Ontario

Office of the President

August 8, 2011

Dear Members of the Standing Committee on Finance:

The Association of Municipalities of Ontario would like to take this opportunity to highlight for the Committee the interests and needs of Ontario’s municipal councils given the role that they play in economic growth and community well being as the Committee undertakes its pre-budget consultation process. We understand that the Federation of Canadian Municipalities will be providing a more comprehensive submission on behalf of all Canadian municipalities; however we would like to articulate the Ontario context and related perspective on some matters as part of the national fabric.

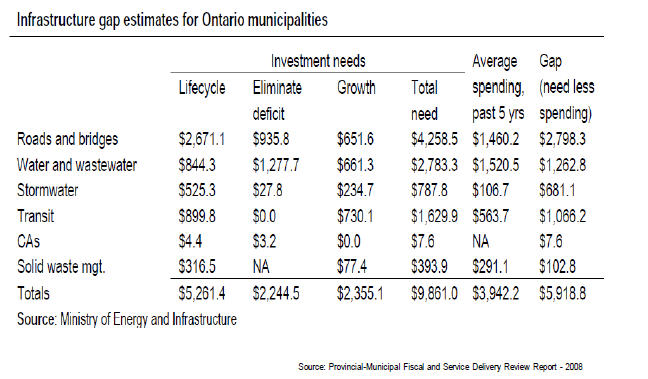

Ontario’s infrastructure is under mounting pressure. Much of it was first built in the 1950s and 1960s and is now deteriorating, requiring modern upgrades or replacement. A growing population is also increasing the burden on existing infrastructure and fueling the demand for new investments. Our research (see attached) has identified that Ontario faces a municipal infrastructure gap of at least $60 billion that will take 10 years to close, leaving municipalities with a bill of $6 billion each year. The Build Canada and the Stimulus Programs have been very helpful but we still have a large challenge, and one that as the research demonstrates is unaffordable and therefore unachievable if only financed through property taxes.

The Federal Gas Tax Fund (GTF) is the only source of predictable and long-term federal funding to help address this gap. It transfers $746 million annually to Ontario municipalities and allows investment in environmentally sustainable infrastructure. Funds are distributed twice annually to all municipalities on a per capita basis and its flexibility allows investment in multi-year priority projects without having to submit a grant application, go through a review process and at the end of the day not know whether the grant effort will result in funding or not. In fact, the Agreement in Ontario is unique because AMO and municipalities have a direct relationship with the Federal Government to administer the Fund, further streamlining and making the federal support extremely efficient. Municipalities strongly support this funding approach - it is based on a strong reporting of expenditure and outcomes and helps municipal governments meet their capital infrastructure investment plans, which reflect local priorities.

We welcomed the 2011 federal budget commitment to enshrine the federal Gas Tax Fund in legislation as a permanent annual source of infrastructure financing for municipalities. AMO supports maintaining the current flexible framework of this program but we strongly encourage the government to index this Fund - to allow it to keep pace with population and economic growth. AMO and its membership would loudly applaud such a move. It would further signal the Government’s commitment to helping our communities across the province - those in urban areas with significant transit challenges for example and smaller towns and rural areas with the need to rebuild their core infrastructure. Municipal governments in Ontario know the needs of their communities - they just need the funding assistance to help them carry out their plans.

The federal budget also committed to work with provinces, territories, the Federation of Canadian Municipalities (FCM) and other stakeholders to build a long-term plan for investing in public infrastructure. The success of this will be that it is a long-term plan that is to be as much about a bottom up as it is about a top down approach - where federal and municipal government interests can coalesce rather than compete. AMO has long advocated for dedicated, long-term, sustainable infrastructure funding programs from both the Federal and Provincial Governments. We look forward to being a part of those discussions, where we can pursue the local needs while also attending to broader national strategic needs.

Another area of interest to AMO is immigration - the importance of responsive immigration policy is greater than ever. Ensuring a federal-provincial agreement that reflects the dynamic economies and communities of this province is imperative. AMO encourages the federal government to renew and enhance the Canada Ontario Immigration Agreement (COIA) with Ontario in the very near future as COIA has provided a successful structure for federal-provincial- municipal support for settlement and integration services and programs for immigrants to Ontario.

Collectively, governments need to work together to overcome the numerous barriers to successful settlement and retention. Immigration policy should include the development of an occupation list (immigration levels) responsive to the dynamics of regional/local economies. The federal government should work with provinces to develop broad occupation lists that reflect skills across multiple applications (health sector, construction, education etc.) and are responsive to regional needs. As well, the development or retention of tri-partite initiatives that support governments working together are needed in order to implement strategies to support the settlement and integration of newcomers including affordability of housing, child care, access to transportation, and employment supports.

Clean safe affordable housing has positive impacts on health, poverty, learning and productivity for our communities and our residents. Housing is a national matter. Unlike the rest of Canada, social housing is a municipal responsibility in Ontario and our municipalities contribute more than $1.2 billion annually to social housing. This represents more than 3% of the annual operating expenditures for Ontario’s municipalities. Is it sustainable given the age and condition of social housing? The capacity for municipal governments to help those on long waiting lists through the use of property taxes alone is not going to improve. Poorly housed, under-housed families are not positive factors for community economic growth and wellbeing either. The three orders of government need to move away from time limited funding and programs and work together on a long-term strategy that establishes predictable funding levels for affordable housing and increases the number of new rental units annually through the use of initiatives. The federal government’s full involvement in affordable housing is absolutely critical to maintaining and enhancing our social fabric.

In conclusion, we strongly encourage the federal government to continue strengthening collaboration with the Federation of Canadian Municipalities so there are government to government discussions at an early stage in any policy development that impacts municipal governments. In Ontario, we have a good model that engages AMO in early, pre-consultation discussion. This assists the provincial government in understanding the municipal fiscal and/or implementation impacts of policy ideas or proposals before they take root, and the process often improves legislation or programs.

Municipal governments are tasked with building communities, annual balanced budgets and delivering a broad range of programs and services. Our objectives are grounded in the knowledge that much more can be accomplished when governments work together.